San Diego Roofers Health and Welfare Plan (3H)

This Plan is considered a health and welfare plan which provides medical, dental and life insurance benefits. For more information, you can download a copy of the Summary Plan Description here.

Coverage is provided by the following providers:

Kaiser Permanente HMO Medical Plan

- Telephone: 800-464-4000

- Website: www.kp.org

Dental Plan

-

San Diego Roofers Health & Welfare Plan

3530 Camino del Rio North #110 San Diego, CA 92108 - Telephone: 800-886-7559

Lincoln Financial

- Life and AD&D Provider (Active participants only)

Eligibility

Only Coast Benefits, Inc. may confirm your eligibility status or accept appeals to the Board of Trustees concerning your eligibility for benefits or for self-funded medical or dental benefits. For appeals on issues with regard to an HMO (Kaiser Permanente) must be directed to that HMO. Appeals for dental benefits must be processed through Coast Benefits.

Your coverage becomes effective on the first day of the second month following any four consecutive months in which you have worked for covered employers for a minimum of 400 hours; example 400 hours combined during February, March, April, May gives eligibility July 1st. Coverage will continue if you work 100 hours per month for covered employers. Hours worked are reported by your employer in the following month and credited to your account the next following month. For example, covered hours worked in January would be credited to your account in February. Hours worked in excess of 100 per month are added to an hour bank for up to a maximum of 400 hours at any one time. When you are not credited with 100 hours in a given month, hours will be withdrawn from your hour bank to make up the required 100 hours for that month. For more information on your hour bank, please contact Coast Benefits, Inc.

To view a summary of the benefits available from these providers please choose a link:

The Trust Fund provides a self-funded dental plan.

If you or your dependents incur covered dental expenses in excess of the deductible, the Plan will pay a maximum of the amount shown in the Table of Allowance for Dental Procedures.

Deductible

The annual deductible is $50 per person. You must satisfy this amount of covered dental expense before benefits become payable under the Plan. The deductible is applied once in each calendar year for each covered person (up to a maximum deductible of $150 per family). The deductible does not apply to charges for the following preventative care services: exam, cleanings, fluoride treatment, x-rays, sealants for children to age 14.

COBRA Continuation Coverage

Every covered person who loses coverage due to a qualifying event may be eligible for COBRA Continuation Coverage. Qualifying events include the death of the participant, divorce or legal separation from the participant, ceasing to qualify as a dependent child, and loss of coverage due to termination of employment or reduced hours. Under certain circumstances, a dependent has a separate right to elect COBRA coverage. For more information on COBRA coverage, please contact Coast Benefits, Inc.

HRA (Health Reimbursement Arrangement)

The HRA Plan is designed to supplement hospital, medical, and dental benefits available to Participants plus provide reimbursement for eligible expenses not covered elsewhere and can be used to pay for COBRA coverage. Effective with hours worked on/after February 1, 2019, $0.25 per hour of employer contributions were designated towards a Health Reimbursement Account. Effective with hours worked on or after July 1, 2019, the rate was increased to $0.50 per hour.

In order to be eligible to use your HRA account, a participant needs to be an active employee and eligible for benefits under this Trust or enrolled in another group health plan that meets the ACA minimum value standards, including but not limited to group health coverage through your spouse.

Qualified Expenses

The Internal Revenue Service defines qualified medical care expenses within IRS Section 213(d). Medical care expenses are further defined as amounts paid for the diagnosis, cure, mitigation or treatment of a disease, and for treatments affecting any part or function of the body. The expenses must be primarily to alleviate a physical or mental defect or illness.

The products and services listed in the document (below) are examples of medical expenses eligible for payment under a Health Reimbursement Account. This list is not all inclusive; additional expenses may qualify, and the items listed below are subject to change in accordance with IRS regulations.

Filing an HRA Claim

Use your HRA debit card. Your HRA debit card is accepted at most merchants where you would have eligible expenses (e.g. CVS, Rite Aid, Costco). You can pay for your eligible expenses with the card, but it will not work for non-eligible purchases (e.g. you cannot use it to purchase non- eligible items at a drug store).

Your HRA debit card is the simplest way for you to access the funds in your HRA account. If you do not receive your HRA debit card, or if you have any questions about your HRA benefit, or how to access your benefits, please call Coast Benefits at 844-739-7956.

Filing Claim Methods

Claims can be filed by fax, mail, online or via our mobile app.

1. To file your claim by fax, download the claim form:

Fax your claim to 877-501-1015

2. To file your claim online:

- Log on here

- Enter your username and password

- Click Login

If you are not already registered for the site, your username will be:

- First Name Initial + Full Last Name + Last 4 digits of SSN (example: jsmith6789)

- The default password is: Coast1 (case sensitive)

You will have 30 days to create a new password. After 30 days, you can create a new password by contacting Coast Benefits at 844-739-7956.

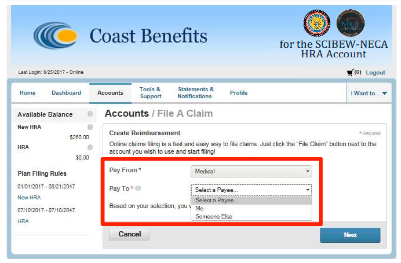

Creating a Payment or Requesting a Reimbursement

After you have logged in…

- Click on the File a Claim button

- On the next screen, select the Pay From drop- down menu and select Medical

- Then go to the Pay To drop-down menu

- To reimburse yourself for a previous expense, select Me

- To pay a provider, select Someone Else

- Then follow the prompts.

For more information please download these instructions and the quickstart guide:

3. To file your claim using our app:

Manage your HRA account from the palm of your hand. Check your HRA account balance and submit receipts from anywhere. You can easily and securely access your HRA account, submit claims and upload receipts anywhere at any time. You have quick access to common tasks with an easy to use design that helps make sense of your health and financial information. Click on link below for help.

Making Changes to Your Account

To make changes such as adding family members, adding student status, and changing your address, contact Coast Benefits. Documentation may be required in order to make any changes.